By Barbara Ortutay

The Associated Press

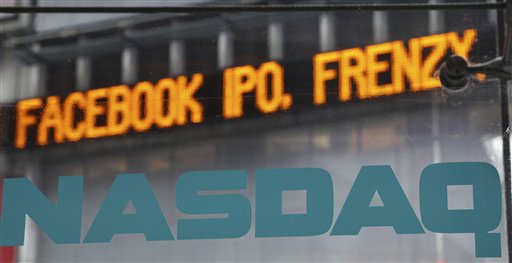

NEW YORK — Already expected to be the largest-ever initial public offering for an Internet company, Facebook is making its IPO even bigger.

The world’s largest online social network on Tuesday increased the planned price range for its stock to $34 to $38 per share in a filing with the Securities and Exchange Commission. That’s up from its previous range of $28 to $35. At the upper limit of $38, the sale would raise about $12.8 billion.

The move, which values Facebook as high as $104 billion, comes amid growing investor excitement about the offering. Analysts are comparing the frenzy surrounding Facebook’s IPO to Google Inc.’s in 2004, though in sheer size the latter pales in comparison.

At the same time, half of Americans think the expected value for Facebook Inc. is too high, according to a new Associated Press-CNBC poll conducted before the company raised its expected stock price on Tuesday. Only a third of those surveyed said they think Facebook’s expected value is appropriate.

Wall Street doesn’t share that sentiment.

“Demand is obscenely high,” said Scott Sweet the owner of advisory firm IPOBoutique about the offering. That said, he notes Facebook still has to be careful not to increase the price too much, so the stock still does well when it begins trading on the Nasdaq Stock Market, as expected, on Friday.

“This is a deal that literally must work, in that it is so high-profile,” he said. “It would really level the IPO market if Facebook flopped.”

As it stands, Facebook would be the fourth-largest U.S. IPO in history, edging out AT&T Wireless, whose 2000 IPO raised $10.6 billion according to Renaissance Capital, an IPO investment advisory firm.

The AP-CNBC survey, meanwhile, found that of average Americans who invest in the stock market, 58 percent think Facebook’s valuation is too high at around $100 billion. That’s larger than well-known companies such as Ford and Kraft but smaller than Google or Microsoft.

About 3 in 10 investors called the expected value fair.

Price worries won’t necessarily stop would-be investors. Facebook raised the price range in response strong demand for its stock, and it’s possible that the stock could price even higher on Thursday.

The Menlo Park, Calif.-based company is offering 337 million shares in its IPO. Of those, 157 million shares aren’t coming from the company, but from existing stockholders, including the company’s earliest investors and CEO Mark Zuckerberg. Even after the offering, Zuckerberg will remain Facebook’s single largest shareholder.

And he will control the company through 57 percent of its voting stock. Based on the high end of the price range, he’ll get about $1.15 billion from the stock he is selling.

The IPO is is expected to raise more than 10 times as much as the $1.67 billion raised in Google eight years ago. At a value of $38 per share, the high end of Facebook’s expected range, Facebook would generate $6.84 billion on its shares. Existing stockholders would collectively make $5.98 billion.

Even at the higher price range, it’s going to be tough for the company’s fans and everyday investors to get in on the IPO. Most of the shares are expected to go to people with connections to the company or those who have large, active accounts with the big banks or brokerage firms directly involved in the stock sale.

Morgan Stanley leads the team of 33 underwriters selected for the Facebook offering, followed by JPMorgan Chase and Goldman Sachs. The company will trade under the ticker symbol “FB.”

Analysts say there’s so much interest in Facebook’s stock that some underwriters are closing their books as early as Tuesday. This means they won’t be taking any more orders from potential buyers.

In its Tuesday filing, Facebook also adjusted the timetable for finishing its $1 billion acquisition of Instagram, saying it expects the deal to close sometime in 2012. Previously, it had said it expected to complete the deal in the second quarter.

Some analysts have speculated that the acquisition of the photo-sharing network would come under regulatory scrutiny. If the deal doesn’t close by Dec. 10, Facebook could have to pay Instagram a breakup fee of $200 million.

———–

Associated Press Business Writers Tali Arbel and Bree Fowler contributed to this report.